With the 8th Pay Commission on the horizon, millions of central government employees and pensioners are eager to know how much their salaries and pensions could increase. While the official implementation is expected around 2026, early discussions have already begun, and the anticipation is high.

What is the 8th Pay Commission and Why Does it Matter?

India’s Pay Commissions are responsible for reviewing and recommending salary structures for central government employees every 10 years. The 7th Pay Commission, implemented in 2016, brought a notable increase in pay scales and allowances. The 8th Pay Commission is expected to follow a similar trajectory possibly with even greater impact due to rising inflation and cost of living.

The main goal of each Pay Commission is to align government salaries with economic realities, ensuring a fair and competitive compensation structure. For employees, this means improved income, benefits, and retirement payouts. For the government, it’s about balancing fiscal responsibility with employee satisfaction and public service efficiency.

How Much Will Basic Salary Increase?

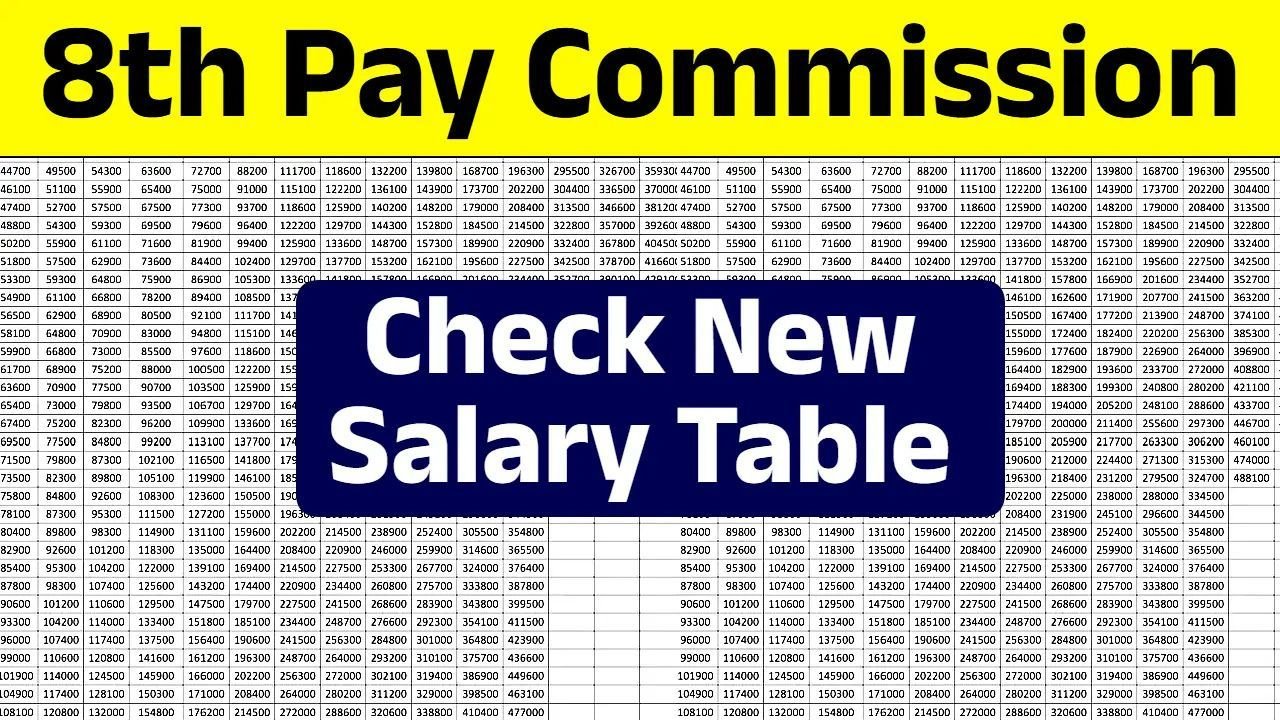

One of the most talked-about aspects is the fitment factor a multiplier used to revise basic pay. In the 7th Pay Commission, this factor was 2.57. For the upcoming 8th Pay Commission, there’s strong speculation that the fitment factor could rise to 3.68.

To illustrate, if your current basic salary is ₹18,000, applying the new fitment factor would push it up to approximately ₹66,240. That’s a 264% increase, not including the additional rise in allowances and benefits.

This hike won’t just affect the basic pay. Dearness Allowance (DA), House Rent Allowance (HRA), and other components are calculated based on the basic salary, so the actual take-home pay could be substantially higher.

Who Will Benefit and How?

The expected beneficiaries include over 50 lakh central government employees and around 65 lakh pensioners. This includes everyone from junior clerks to senior bureaucrats, as well as armed forces personnel and employees of centrally funded autonomous bodies.

A significant salary revision like this doesn’t just affect individual households it has ripple effects across the economy. Increased disposable income leads to higher consumer spending, boosting sectors like real estate, retail, automobiles, and banking.

When Will It Happen?

While the official timeline suggests implementation by January 2026, employee unions have already started demanding an earlier rollout, citing rising inflation and economic pressures. Some sources suggest that political considerations, especially with elections approaching, could lead to early announcements or partial implementations.

The Broader Economic Picture

While a generous salary revision may be welcomed by employees, it also places a financial burden on the government. A larger salary bill means adjustments may be required in other areas such as fiscal spending or tax policy to maintain economic balance.

That said, past commissions have shown that the long-term economic boost from increased spending power often helps mitigate these fiscal challenges, especially when combined with smart tax and economic policies.